Basic financial learning curves are best learnt early in life, they will benefit you in your youth as well as in the future. Managing debt is one such important learning curve and a credit card is a transactional tool through which this experience can be gained. The sooner you teach your children to be disciplined in handling a credit card, such as paying back debt and controlling the associated interest and fees, the better. This can […]

Continue readingMore TagSouth Africans lack confidence when it comes to finances

Most South African consumers feel challenged by their finances, with relatively few saying that they are highly successful at sticking to their financial goals or are knowledgeable about financial matters.This was revealed when the Financial Planning Institute of Southern Africa (FPI) conducted a nationwide survey, in conjunction with the Financial Planning Standards Board (FPSB) and a global research firm (GfK), to determine South African citizen’s financial attitude compared to that of the average global citizen.Both primary […]

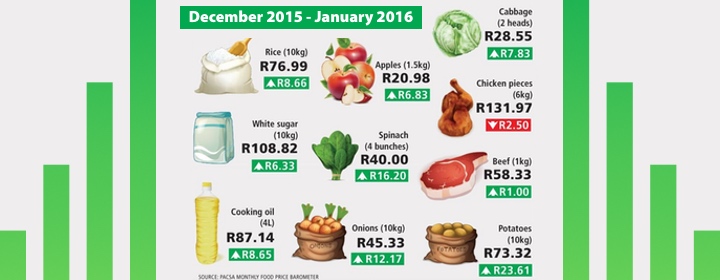

Continue readingMore TagFood costs eating through our pockets

Certain provinces have been struggling to keep up with the skyrocketing cost of food. Current data points to an agriculture industry that is struggling, mainly due to the diminished buying power of the rand and a prolonged drought.November 2015 saw the worst drought in South Africa in 23 years. During this time Stats SA released figures showing three consecutive quarters of steep decline in agricultural activity, forcing South Africa to import maize to make up for […]

Continue readingMore TagRetirement doesn’t happen at 65…

Retirement planning is only one component of a holistic financial plan and although retirement has a higher probability than all the other risk areas, this is the area we find people being the worst prepared for. Retirement doesn’t happen at 65… it happens when you make it happen!Planning for retirement is much like planning a flight in a light aircraft. Before you embark on this journey you have to check if your aircraft is in a […]

Continue readingMore TagRetail Distribution Review – Prepare for advice fees

For the first time in South Africa, financial advice is set to become a billable service. Known as the Retail Distribution Review (RDR), the first phase will be implemented later this year (2016), introducing some significant changes for both consumers and financial advisors alike.As with all change, some sound preparation and a positive outlook will make for a smoother adjustment. One of the main changes in mindset is to accept that making direct payment for financial […]

Continue readingMore TagSurviving the weak Rand

South Africa’s weakened Rand is bound to have a negative rippling effect on our economy. The cost of food, electricity, water and imported goods are all set to rise. Now is as best a time as any to take secure control of your finances.Budget According to the National Credit Regulator (NCR), as at June 2015 a shocking 11 million out of more than 23 million credit active consumers had impaired credit records or had failed to […]

Continue readingMore TagThree Trends set to Shape Professional Industries

I found a great article talking about some of the major themes that are predicted to influence professional industries this year. A big part of running a successful business is staying up-to-date with current trends that are affecting the marketplace.Here are three trends that are set to be prevalent this year:Trust as the key competitive advantageIt is said that no publicity is bad publicity, however that was before the dawn of the internet. The value of […]

Continue readingMore TagRetirement tax reform

Also known as The Commutation of Benefits, there are some big changes coming for retirement and provident fund holders. Essentially, these all relate to how the money is drawn (commuted) or re-invested.After being delayed by a year, the Taxation Laws Amendment Act is being put into place on 1 March 2016 (‘T-day’). The legislation changes seek to balance out the tax treatment for the different types of retirement funds.First, there are changes on how much of […]

Continue readingMore TagAre you an employer?

Many of my clients run their own businesses, employing staff and looking for ways to grow their business. In this busy way of life, it’s easy to overlook or lose track of changes in the legislative systems that affect employers.Here are some important legislative changes will be affecting all employers and retirement fund members from 1 March 2016 (‘T-day’). Seeking to create a uniform retirement fund system for all types of retirement saving vehicles the following […]

Continue readingMore TagThistle save you a buck

With Valentine’s Day around the corner I thought I would write a piece about the proper procurement of flowers. What to look for and how to get the best bouquet for your buck.Starting with the obvious, if you are buying flowers for someone special then it’s best to know either their favourite kind of flowers are or at least some of the symbolism behind the flowers that you plan on buying. (Red is love, yellow is […]

Continue readingMore Tag