In a recent article from Morningstar, they raised two excellent points about measuring financial success.

Like so many of us, Morningstar believes that great investing advice means understanding our hopes, dreams, and ideals to determine what really matters. It doesn’t just focus on the finish line — it focuses on the journey. Great advice can help people reach their goals.

But what exactly does this look like? How do we measure financial success and reach our goals?

According to the latest research, true financial success comes from two viewpoints: actual financial progress (the numbers) and financial wellbeing or empowerment (the feeling of success or security). These are both important to this conversation as the evidence shows we must achieve both.

A good place to start is to consider our financial progress and our financial wellbeing on a scale of 1 to 10. They can be independently rated as the one will be fairly objective (based on the numbers) and the other will be fairly subjective (based on our feelings). Looking at it in this way can also help us understand which we currently value more than the other and help reframe our perspectives.

For some of us, we will find that if the numbers are good, our feelings are good. For others, we might find contentment regardless of the numbers.

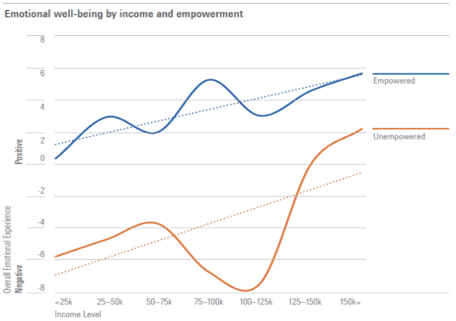

To demonstrate the evidence, the graph below compares people who feel empowered by their finances with people who don’t. It shows empowered people had mostly positive experiences with their finances, even in the lowest income ranges. Those who felt disempowered were less happy than their peers and didn’t reach the positive range until their annual earnings were well above $100,000 (US-based stats).

Source: https://www.morningstar.com/lp/when-more-is-less

Traditionally, financial planning and advice have centred around “crunching the numbers”. This was because it was perceived as more of a management function and not a relational function. In recent years we have seen a shift from financial planning being a transactional engagement to being more relationship-centric, with products and services taking a back seat along the journey and the advisor riding upfront with their client.

Instead of being on the sidelines, we are partners in prosperity on your road to financial success. The lesson here is fascinating: A sense of financial wellbeing—as well as the money itself—may be the key to success in our financial lives. So, please reach out to me if there are some behavioural traits, such as reinforcing good investing habits, that we can help with.

Even if you have enough assets to withstand a reasonable economic shock, it doesn’t mean that you won’t be anxious about your finances. On the other end of the spectrum, some of us aren’t in the greatest place economically, and despite best intentions, we still spend with abandon because we feel fine about our finances.

If we want to be truly successful, we must find a balance between the two.