Last year I shared an article on my blog that spoke to the stark reality of the tragic impact that cancer has had (and continues to have) on almost every family in South Africa. It’s very rare, in fact, to meet someone who hasn’t either had cancer themselves, or has a close family member who has been diagnosed with some form of cancer. As I wrote in my previous blog, cancer has increased exponentially and is, […]

Continue readingMore TagEND OF THE MONTH SAVING TIPS

It’s never too late to learn something new! With the current pace of change, the human race is being forced to become better adapted to change – and that means that we are constantly learning new things. Whether it’s the software on your phone, the new car, a new job, a new relationship… we’re constantly learning something new. The same should apply to your approach to saving and spending your money. Here are five, level-headed, fresh […]

Continue readingMore TagA DIFFERENT APPROACH TO DREAD DISEASE COVER

One of the reasons that I have my blog and Facebook page is that this industry changes about as regularly as the price of petrol. A financial solution that we relied on five years ago may still apply, but it also may not. There may be better options, better approaches; better products, for your needs. This is a place for me to share some of the newer ways of looking at financial planning. When it comes […]

Continue readingMore TagE-CIGGIES… THEY COST MORE

A brief walk through any public space will reveal the presence of a new type of technology. It’s not a new phone or tablet, it’s a cigarette; an e-cigarette. I came across this article in an email that explains why life insurers apply a loading for the use of e-cigarettes. E-cigarettes are becoming increasingly popular, but they’re no stranger to controversy. The latest news on the topic highlights the increasing number of governmental regulations kicking in […]

Continue readingMore TagWOMEN NEED TO PRESERVE THEIR FUND BENEFITS

Why do women need to preserve their fund benefits? Deep inside every man is the knowledge that women are stronger, more clever and just all-in-all better than us. Men seldom admit it, but they know it. What’s more is that women live approximately seven years longer than men do, which means that a woman aged 65 will need approximately 15% more than a man of the same age to provide the same pension for the rest […]

Continue readingMore TagTHINKING ABOUT VITALITY? NOW’S THE TIME TO CHOOSE!

Whilst I work with a variety of products – every now and then a super-duper deal comes along that I simply have to share on my blog! Discovery Life’s Integration philosophy of incentivising health and wellness management has resulted in powerful outcomes. Engaged clients experience 40% fewer claims than non-Vitality members and lapse rates of engaged clients are 65% lower than non-Vitality members. In order to ensure continued engagement, Discovery Life is introducing the Double GuaranteedPayBack […]

Continue readingMore TagHOW DOES YOUR BUDGET SHAPE UP IN SA?

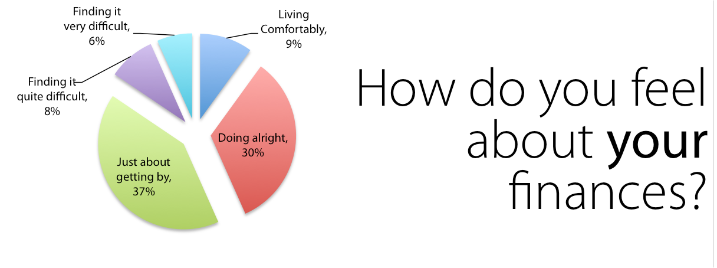

Whilst I always view clients within their unique situation and tailor their financial plans to their needs and goals, part of knowing how to guide them involves an awareness of current trends and the economic landscape. One of these measures is found in the Old Mutual Savings & Investment Monitor that was published in early August 2014. Essentially, this survey asks the question: ‘Are you financially comfortable?’ They looked at households from metropolitan areas that were […]

Continue readingMore TagWHAT KIND OF INVESTOR ARE YOU?

Recently I’ve shared several articles on investments, and then I came across this gem from Discovery! It digs a little deeper into understanding your own, personal, risk profile and how that pertains to your investment choices and behaviour. Remember, this is a snapshot typical behaviour types; before making any investment choices, let’s chat first! Identifying and understanding your risk profile will help guide us to the types of investment funds that suit your specific financial goals. […]

Continue readingMore TagHOW LONG SHOULD I INVEST FOR?

How long is a piece of string? Well, the answer is actually simple: as long as you need it to be. If you have to cut a piece of string, you’ll start with what you need it for. You measure your need and then you cut the string. You don’t work the other way around, otherwise you will waste the string. The same is true for your investment needs. When approaching an investment plan, or structuring […]

Continue readingMore TagLIMBO WITH THE LINGO

Whether you’re casting your line off the end of a pier or buckling your seatbelt, we all deal with risk and return. Somehow, when it comes to emerging markets, nominal vs real, risk-adjustments, multi-asset portfolios, protection strategies and bull vs bear markets we panic amidst an onslaught of lingo that overwhelms us. Basically, when it comes to investments, it helps to bring things back to casting your line off the pier or buckling up, because we’re […]

Continue readingMore Tag